Top Media Planning Tools You Need in 2022

Organizations invest money and efforts in choosing the right channels to deliver their marketing campaigns. But the process of media planning can be time consuming and complex. To be effective, marketers need tools, templates, and software that streamline the media planning process, as well as help analyze and track performance and budget.

In this post

So, how do you choose the right media tools? Here we bring you the top list you should consider in 2022.

What Is Media Planning?

Let’s start with a definition:

Media planning is a process used by marketers to decide when, how often, and where they will run ads to achieve the organization’s marketing goals.

The media plan includes instructions on how to distribute the budget and resources, the channels they will use, and what type of ads will be run.

Elements of a Media Plan

What is in the media plan?

The media plan should be detailed and clear. Besides a detailed budget, it should contain the steps you’ll take for your advertising strategy, which channels will you use for your ads, and how frequently will you run them.

Some of the elements that you may find in a media plan include:

- Your business goals: you should align the strategy with the organization’s general business goals.

- Your audience: who does your ad need to reach?

- Your conversion goals: what are your goals for this campaign? What would you consider a successful outcome?

- Your budget: what’s the budget you can or will assign to this advertising campaign? How is the budget distributed among the different ad types and channels?

- The pricing model: what pricing model will you adopt? Cost per click, Cost per Mille, or Cost per Action?

- The media channels: What media channels will you use for each ad type? Where will you advertise?

Learn more about media planning with our Essential Guide to Media Planning and Free Templates

Top Media Planning Tools

There is a myriad of media planning tools available, both free and paid. We ranked the best options for you:

1. Hubspot media planning template

Source: Hubspot

If your focus is budget tracking, the Hubspot media plan template is a complete solution. It features automated reporting, tracking and attribution. You also get charts that adjust automatically to spending and ROI. The best feature? It is free to download.

2. Media plan HQ

When spreadsheets—no matter how advanced—are not enough, it is time to move to a scalable platform. Media Plan HQ enables you to manage multiple media plans with a clear structure. It allows the creation of detailed media placements, capturing the information the team needs to execute media placements from booking to delivery and attribution. The platform also tracks media spending and enables split budgets in campaigns.

3. BluHorn

This platform is focused on programmatic media buying. It integrates data from Social media and ad networks into a proprietary programmatic buying portal. It is integrated with Google Analytics so you can compare spending to traffic results. The platform is cloud-based, so you can access your data and resources from anywhere, anytime. It integrates with Nielsen, Google Analytics, Facebook, and AWS.

4. Quantcast Media Planner

It is a service for agencies and marketers that helps them find audiences that match their campaign targets. The service is free and provides users with visibility into audiences, reporting and analysis in a single platform. Quantcast Media Planner enables marketers to segment searches by demographics and interests. It is AI-powered and gives fast granular insights.

5. Comscore

Is a tool for planning and analyzing media across platforms. It gives marketers data on digital platforms, television and film. The service provides audience data and insights that help marketers plan their media.

Difference Between Media Planning and Buying

Usually, there is confusion between media buying and media planning terms. Let’s clarify.

What is media buying? Is the purchasing of advertising space from a media channel. Before the Internet, media buyers would purchase buying time from a tv station, print or ad space from a magazine, or billboard signs.

With the appearance of online marketing, now media buyers can purchase ad space on a website, or set programmatic bids on ad networks.

Thus, there are two main types of media buying:

- Manual (direct): Direct buys happen when media buyers negotiate ad space inventory directly with publishers.

- Programmatic (automated): Here, media buyers buy ad placements with the help of automated technology.

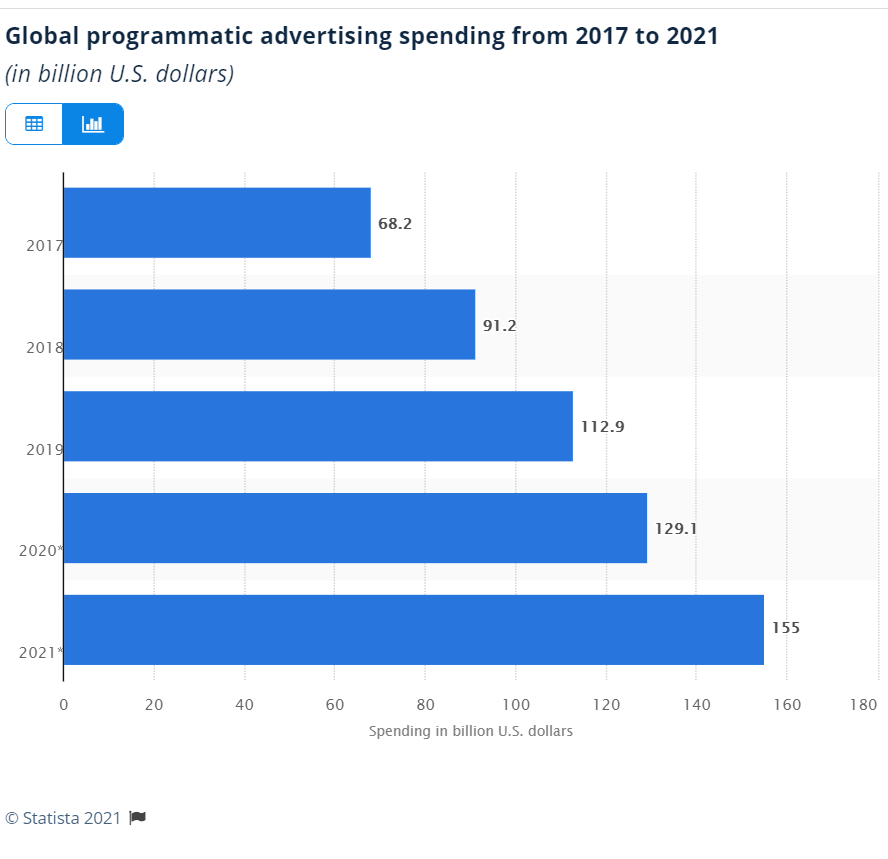

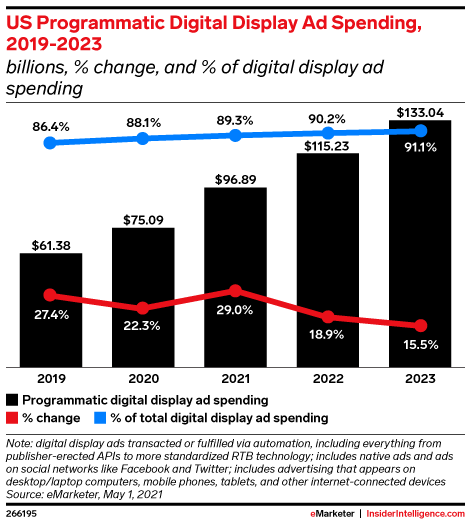

According to eMarketer, programmatic buying is fastly becoming the standard for media buying, with 90% of the digital ad budget spent on programmatic buying.

Want to learn more? Check our Media Buying Ultimate Guide

Types of Media Planning

Selecting the right media channels for your campaign can be a bit tricky. The best strategy should be based on what makes your audience tick, which media they consume. It makes no sense to publish in offline media for a digital audience, for example. Most organizations are using a combination of channels, which is called the media mix.

| Media mix: This is the combination of media channels an organization uses to meet its marketing goals. |

What should you include in your media mix? Again, it will depend on your audience, and campaign objectives. Here are some of the most popular media channels marketers use.

Offline Media

-

- Print media: Magazines and printed newspapers are not dead, and could be a good way to reach a targeted niche. For example, when advertising for a local audience. In addition, newspaper and magazine readers are usually higher educated and with a higher income.

- Radio: Radio still has appeal. It is a low-cost medium and highly effective when combined with other media. While it is common to listen to online broadcasts and podcasts, 68% of U.S adults still listen to the radio.

- TV & Cable: TV is still highly visual and has all the advantages of a video channel. You can demonstrate a product in real-time. Despite the enormous popularity of streaming media, Americans still watch an average of 3 hours and 17 minutes a day.

- Outdoors media: billboards can get a lot of attention. They can be expensive, though, with rates in the US ranging from $1500/month for a billboard in Philadelphia to $20000/month in NY. Billboards on the right side of the road, are typically more expensive than those on the left side of the road. Traditional outdoor billboards are also less invasive and highly trusted by viewers.

Online media

- Social media: It is a cost-effective medium and one that can be finely targeted to reach the intended user. Social platforms offer brands to connect with user communities interested in their type of product, or service.

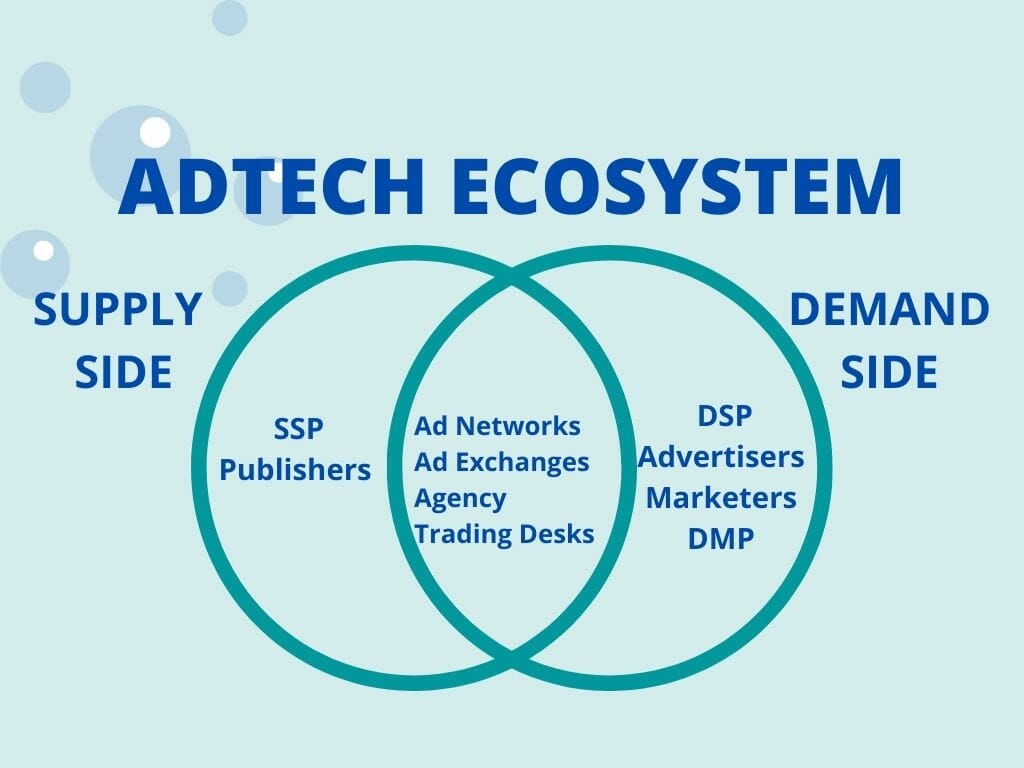

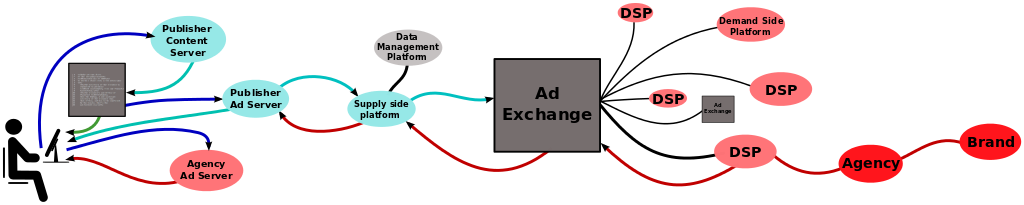

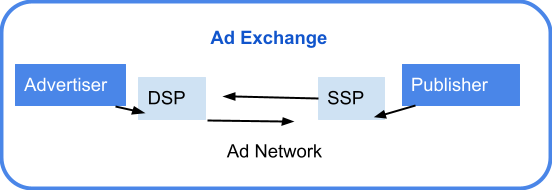

- Programmatic advertising: Programmatic advertising is the automated way to select the best ad placement for an ad and the best advertiser for a publisher. This technology uses an algorithm to find and target the right audience for each ad, across digital platforms. The entire process takes seconds, via an automated bidding process. There are two main bidding methods:

- Programmatic bidding: this method enables advertisers to use demand-side platforms to buy ads on ad exchanges and supply-side platforms based on their target audience.

- Pay per click (PPC): It is a cost-effective medium, where advertisers pay for every click their ad gets. It also enables publishers to retarget people that visited their sites.

- Real-time bidding: it allows advertisers to bid on impressions geared to their target audience. If their bid wins the automated tender, their ad gets displayed.

- Digital publications: newsletters and other digital publications offer advertisers the opportunity to reach their database via a personalized newsletter, a direct email, or sponsored posts. As many blogs and digital magazines are specialized, they make it easy to reach your target audience and generate leads.

Why Do You Need Media Planning Tools?

Media planning is a continuous process that requires effort to keep the campaigns aligned with the marketing goals. You need to adapt to the needs of your audience and understand the channels you can use to spread your company’s message.

Trying to get an effective media campaign without the help of technology is practically impossible these days. You need tools, templates, software, and data that give you insights and provide a framework you can follow.

Simply put, media planning tools make your work easier by helping you manage the different channels, resources, and messages you use in media planning and buying.

What To Look For in a Media Planning Tool

Media planning tools need to help with high-level tasks, like budgeting, planning, and pulling reports. You need a tool that gives you visibility over your entire campaign, especially when you are running multiple campaigns.

Two characteristics that can solve the above pain points are first, using cloud-based media planning and management solutions, and second, using tools that integrate well with your existing software.

Here are key features you should look for when shopping for media planning software:

- Data structure and organization: controlling the data taxonomy, naming conventions, and tagging is critical to organizing it. I prevent classification errors and missing data. When looking for media planning software, look for a solution that enables you to customize your data classification.

- Streamline work process: global teams don’t need to use a different app for each task to accomplish, an integrated single platform with collaboration features and storage.

- Campaign tracking and optimization: look for a solution that simplifies tracking campaign metrics and performance. Integrating with social media, and ad network platforms are a plus.

- Results and reporting: measuring the campaign performance, engagement, and spending requires serious reporting capabilities. The best media planning tools generate custom dashboards that give you easy visibility and reporting.

- Security features: in the age of data breaches, protecting your marketing data from unauthorized access is vital. Look for a solution that includes strong user access permissions control and other security features, like encryption, and traffic monitoring.

- Customer service and support: installing a new platform can take some time and a learning curve. Look for a solution that offers dedicated customer support, FAQs, and a knowledge base so you can hit the ground running with the platform.

How To Craft The Perfect Media Strategy

When you start with the media plans, here are some tips you can follow:

- Choose the media channels that offer the most reach: analyze which media outlets can maximize the exposure to your target audience. For example, advertising on live-streaming events ensures your audience is already watching the program live.

- Set clear goals: what do you expect from the campaign? Is the goal to increase brand exposure or lead generation?

- Focus on engagement: what media mix will encourage your audience to talk about your brand? Pick a strategy that will work with what makes your audience tick.

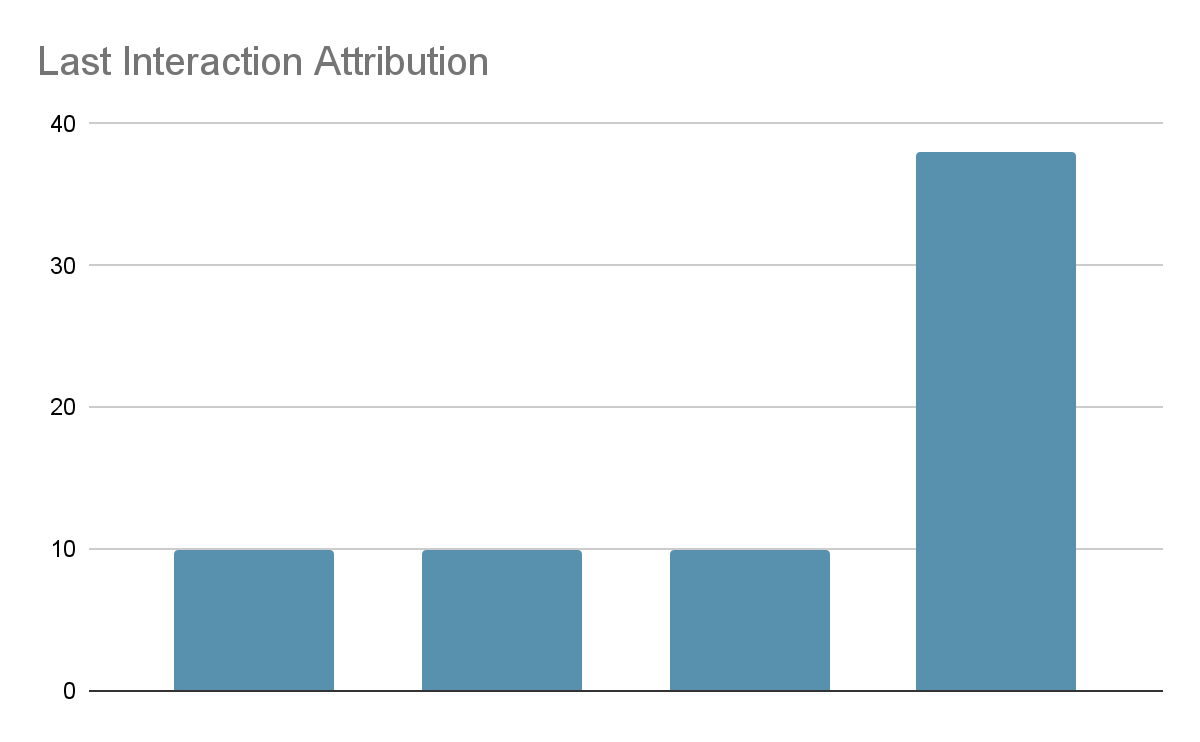

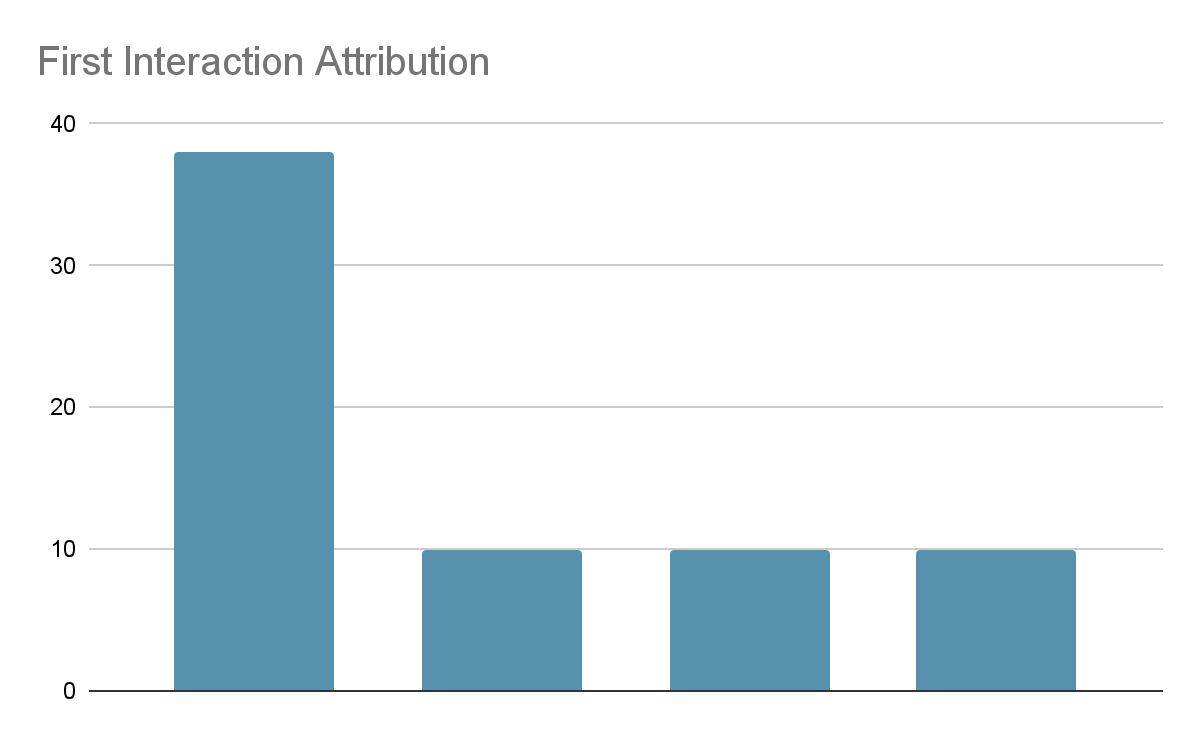

- Select your attribution models wisely: your attribution model can effectively track online and offline media. The right attribution model can help your team make data-driven decisions.

Increase efficiency and profitability

Media planning tools can increase the efficiency of your media buying strategy. But if you want to boost your revenues using a monetization platform is the way to go. In addition to leveraging the right channels for your strategy, working with CodeFuel helps you maximize yield through optimizing your landing pages. Wherever you buy media, with CodeFuel you enjoy the flexibility to deploy your monetization pages in conjunction with other offers, on your domain or utilizing our ready to go pages. Talk to us today and start maximizing your media and marketing efforts.