In this post

An effective marketing strategy is based on data. That’s why it is critical for marketers to stay up to date with the latest statistics, trends, and developments in the industry. Having access to the right data about SEO, consumer, content marketing, social media, marketing trends, will give your company a cutting edge over your competitors.

Yet, too much information can be overwhelming. Here at CodeFuel, we’ve got you covered. We collected a list of the top marketing statistics you should watch in 2021.

1. SEO Statistics

93% of online experiences begin with a search engine. If almost all online activity starts with a search using an engine, then, SEO plays a critical role in getting your website seen. You want users to find your site as a result of the keywords they are searching. If they can’t find you easily, they will find your competitors. SEO has an undeniable value by letting your So audience find you, and the higher your rank, the higher the chances your customers will find you. Here we collected some mind-blowing statistics you need to know about search engine optimization.

Conversion Rate Optimization (CRO)

- The highest impact in conversion rates happens in the first five seconds after a page load. If the page takes longer to load the conversion rates drop a 4.42% with each extra second.

- Landing pages have a 24% conversion rate.

- Popups have only a 4% conversion rate.

Ecommerce

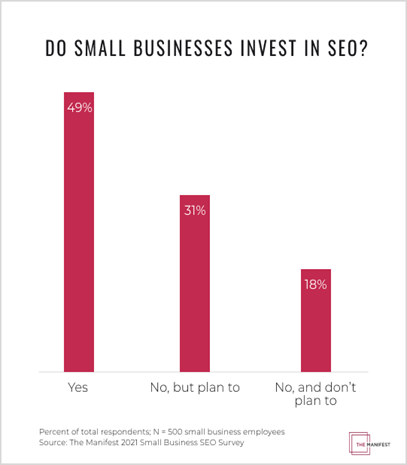

- Only half of the small businesses invest in SEO techniques and activities. Almost a fifth of small businesses don’t plan to invest in SEO in the future, while 30% say they plan to invest in SEO in the future.

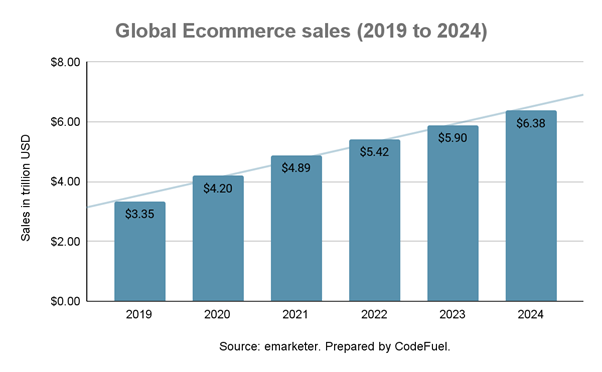

- Global B2C commerce is expected to reach $5 billion at the end of 2021.

In addition to this, almost 20% of global retail sales are expected to come from online sales. Despite the re-opening of brick-and-stone stores, online sales will continue growing and take more shares from retail sales. Online sales are expected to reach over $6.8 trillion.

- More than half of shoppers (59%) surveyed by Google say they use Google to research a purchase they plan to make online.

Local SEO

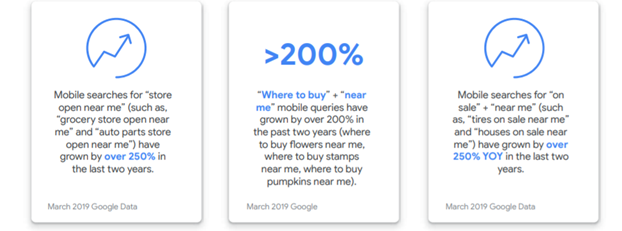

- 30% of mobile searches are related to location — “where to buy” type searches—. (Think with Google)

- 45% of online shoppers choose store pickup. (Think with Google)

- Location queries like “Where to buy” and “near me” grown over 200% from 2017 to 2019.

Mobile Search

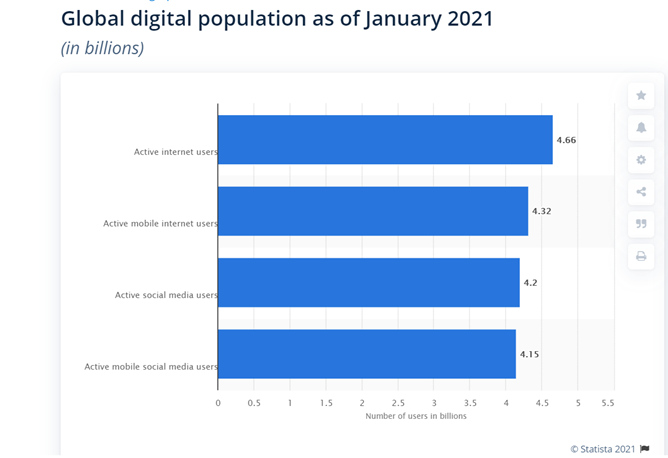

- According to Statista, as of January 2021, the number of active mobile internet users was over 4.3 billion.

- In the US, the average user has 10 connected devices in their household. (Statista)

- 56% of people use their mobile devices to conduct organic searches.

- According to Google, 60% of smartphone users contact a business directly via the search results “tap to call” option.

- 39% of smartphone users consider it is easier to browse and purchase from a mobile app or mobile site.

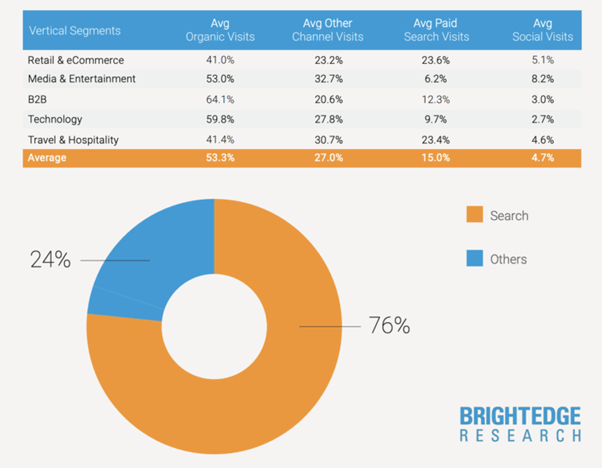

Organic Search

- 53% of all trackable website traffic, comes from organic search.

- The first Google desktop search result gets 32% CTR.

- According to Ahrefs, 90.63% of pages don’t get organic search traffic from Google.

- 50.3% of browser-based searches result in no-clicks.

- According to a study by Brightedge, SEO drives 1000% more traffic than social media.

- 64% of marketers invest time in SEO.

- The average CTR from image results on Google is 0.21%.

Voice search

- 27% of online searchers use voice search on mobile.

- 40 million Americans own smart speakers and the number is expected to rise to 55% by 2022.

- 32% of marketers use smart speakers like Alexa.

- ⅓ of the US population uses voice search features. (emarketer. 2019), and it is expected to reach 122.7 million users by 2021.

- According to PWC, 71% of consumers prefer to use voice search than type their queries.

- According to Finances Online, half of the users use voice search when driving, or combined with other activities. In addition, speakers are becoming integral parts of homes.

- Adults usually use voice search to locate stores or businesses they want to buy from.

2. Content Marketing Statistics

Content is king, we have heard about it for the last decade. But how important is in reality having a great content marketing strategy?

Simply put, quality content engages the viewer and gives the answers to their queries. It encourages brand recognition and conversion. We’ve prepared an infographic on the importance of content marketing based on a recent survey

Now that we stated that content marketing is an essential strategy let’s break it down by exploring some statistics on content marketing tactics.

Blogging

- 53% of marketers use blogging as one of their top content marketing strategies.

- If your brand has a blog, you can expect 67% more leads than those that don’t have a blog.

- More than half of marketers use content marketing to build loyalty among the audience.

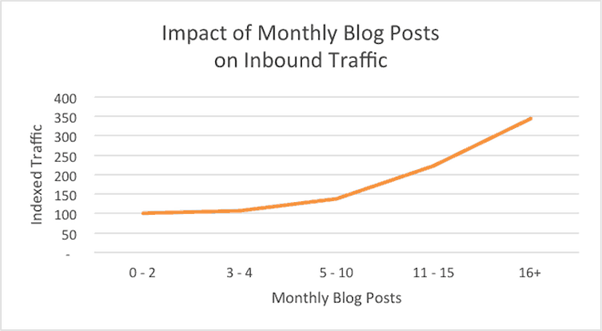

- How often should you publish blog posts? Companies that publish more than 16 blog posts a month get 3X more traffic than those that publish 4 posts a month.

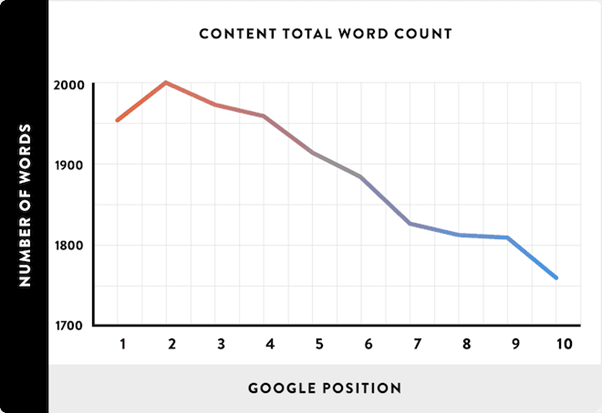

- How long should your posts be? The average word count of a top-ranked post is 1,890 words.

- Posts longer than 2,000 words are the ones that rank higher in Google’s search results.

- According to Hubspot’s analysis, the posts with more organic traffic have between 2,250 and 2,500 words.

- Which type of content gets more results? According to a survey by Orbit Media, “Guides and ebooks” perform better, followed by “How to” articles, and original research content.

Video

- Video content is the most popular content format as of 2020, according to HubSpot.

- Which types of video content are the most popular? Promotional videos and brand storytelling and the most common types.

- 19% of bloggers are including video in their blog posts.

- 72% of people prefer to learn about a product through a video than reading a text.

- Video marketing is expected to grow to $22 billion by 2021.

Engagement

- Visuals generate 600% more engagement than text-only posts.

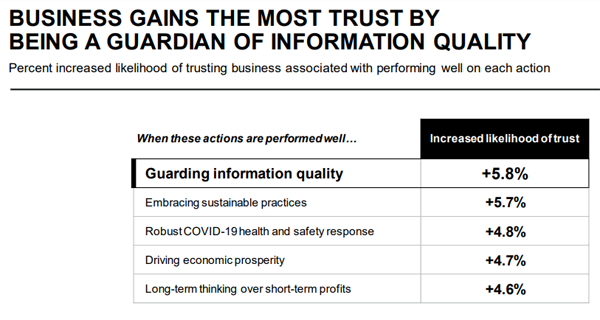

- According to Edelman’s Trust Barometer, businesses gain the most trust by preserving the quality of information.

- According to a survey, 72% of marketers said content marketing increases engagement.

Content Strategy

- 70% of marketers invest in content marketing (Hubspot).

- Traffic is one of the measures of success for content marketing strategies.

-

- Marketing for multiple audience segments is a common content strategy (HubSpot).

- 77% of companies say they have a content marketing strategy (SEMrush)

-

- Creating topic clusters, may increase traffic and improve the search ranking. (HubSpot)

- 70% of marketers admit to lacking a consistent content strategy.

Podcasts

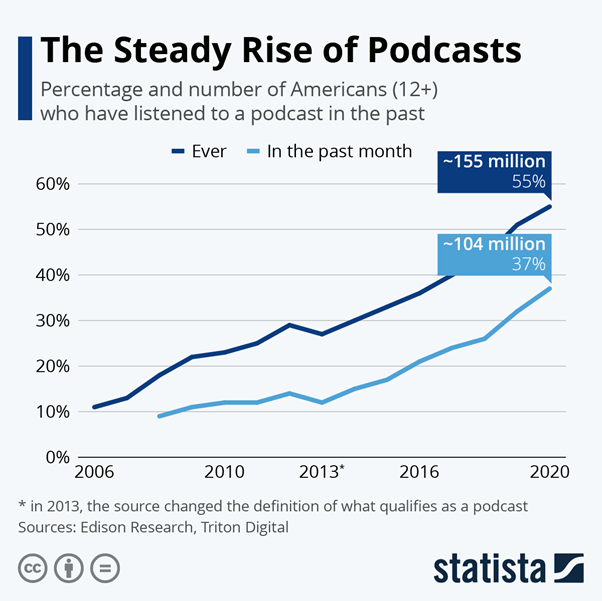

- The popularity of podcasts has increased in the US in the last few years. According to iTunes insights, as of 2020, there were over 30 million podcasts episodes.

- According to Statista, 37% of Americans listen to podcasts monthly.

- 75% of Americans have listened to a podcast, (Edison Research, 2020).

3. Social media statistics

Social media usage

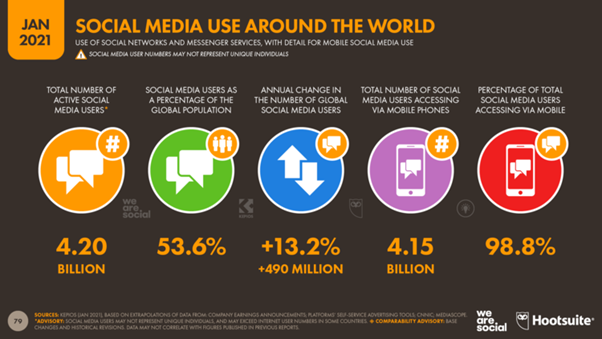

- The number of people on social media globally has reached 4.2 billion, increasing more than 13 percent since 2020.

With that in mind, it is critical for marketers to tap into social media platforms. Not only to distribute content but to create brand awareness.

- According to Statista, in 2020, the global social penetration rate was 49%.

- The most popular social network is Facebook, according to Statista.

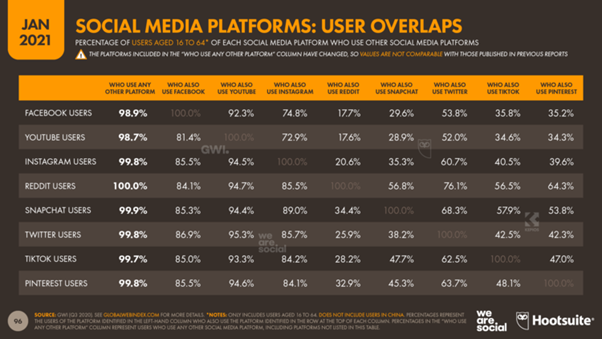

- Users overlap, and Facebook users usually also use YouTube. 74% of Facebook users also use Instagram. Therefore, it is better for companies to identify the two or three platforms their users are on, and invest their marketing efforts in them.

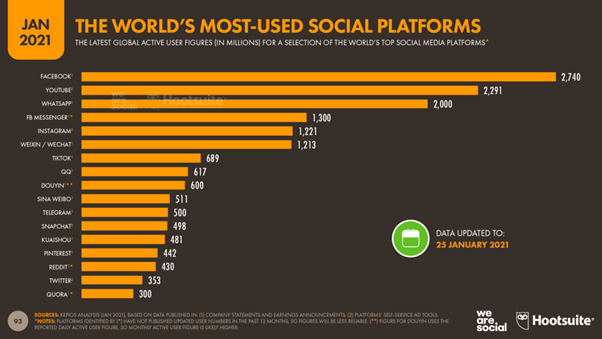

- The most used social media platforms are Facebook, YouTube and Instagram.

- According to Statista, close to 800 million Chinese Internet users would access social media networks in 2023, from 673,5 users in 2018. (Statista)

- 2.8bn active users worldwide.

- 98.3% of Facebook users access the platform via mobile phone.

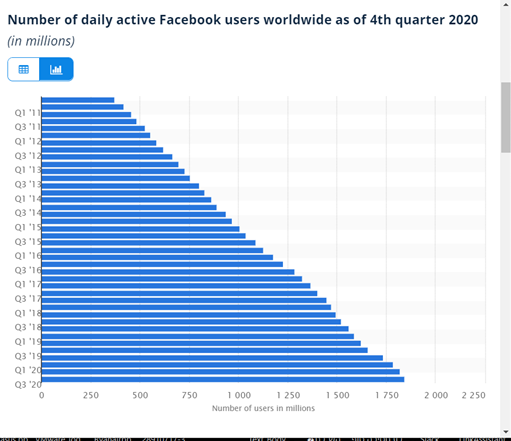

- 1.85bn daily active Facebook users worldwide.

- 8 million is the number of active advertisers on Facebook, mostly small and medium-sized businesses.

-

- More than 100 million people use Facebook Watch daily (Facebook).

- Facebook is the top content distribution channel for marketers.

- 79% of video marketers publish on Facebook as a video marketing channel (Wyzowl)

-

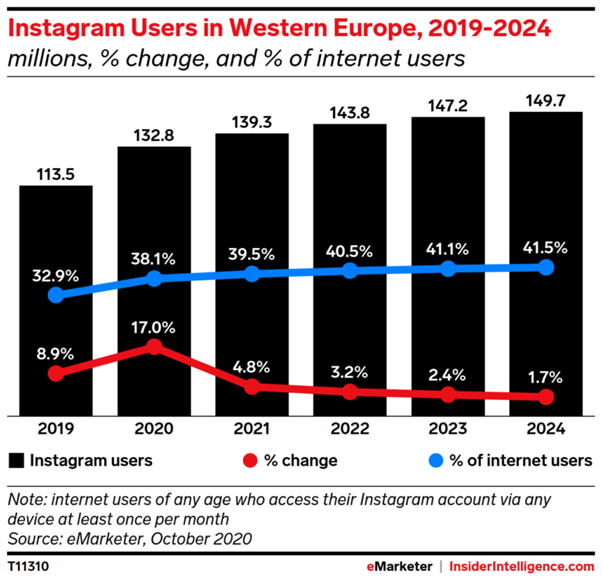

- There are 1,074bn Instagram users

- 71% of Instagram users are under 35.

-

- The average Instagram post has 10.7 hashtags.

- 500 million Instagram users use IG Stories every day.

- 71% of US businesses are on Instagram.

- 50% of Instagrammers follow at least one company.

- Instagram is the channel with the second-highest ROI for marketers.

- 88% of users are outside the U.S.

- By 2024, it is expected that Instagram will reach 149 billion users in Western Europe.

- 81% of consumers use Instagram to research products and services.

- 130 million users use the “tap to shop” Instagram feature.

- 58% of users say they are more interested in a product after seeing it in IG Stories.

- The average Instagram business account posts at least once a day.

- Instagram’s potential reach from advertising reached 1.16 billion users in Q# 2020.

- 740 million active users in LinkedIn

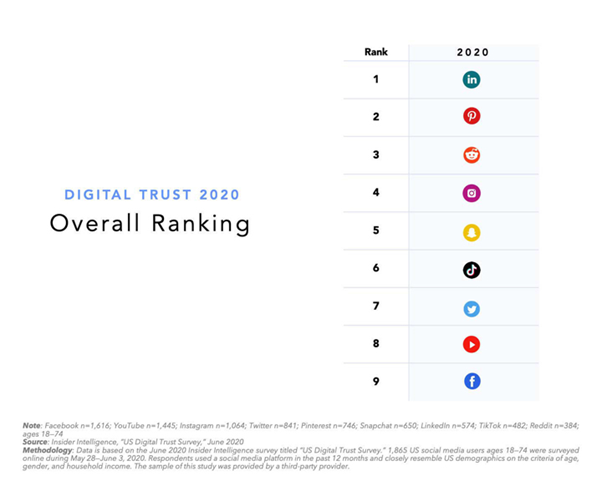

- According to Business Insider, LinkedIn was the most trusted network of 2020.

- Most popular platform for B2B marketing. (Content Marketing Institute)

- The most engaging LinkedIn posts are posted on Wednesday mornings.

- LinkedIn conversion rates are higher than Google Ads (LinkedIn)

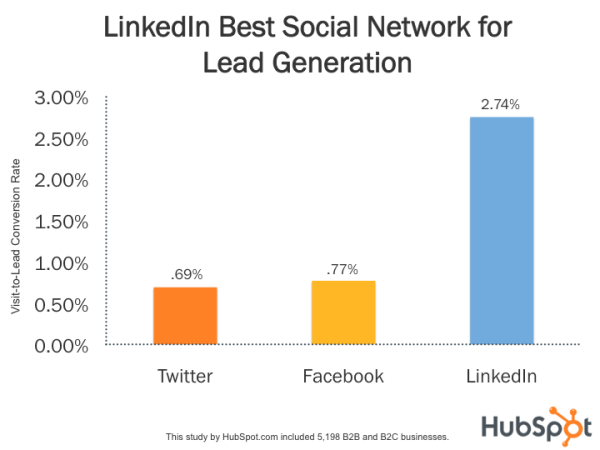

- According to a HubSpot study, LinkedIn generates more leads than Twitter and Facebook.

- There are more than 55 million companies listed on LinkedIn.

- LinkedIn ads are more than ⅓ of the platform’s total revenue in 2020.

- As of January 2021, the number of global active users is 459 million.

- Monthly active users grew 46% in 2020.

- Women outrank men on Pinterest, but in 2020, the number of men in Pinterest increased to 40%.

- The potential audience of Pinterest advertising is 200.8 million, with 77% of the audience female and 14.5% male.

- 80% of people that Pin weekly discovered a new brand or product on Pinterest.

- 85% of Pinners go to Pinterest when they want to start a new project.(Pinterest)

- Yet, 97% of Pinterest searches are unbranded. (Pinterest)

Snapchat

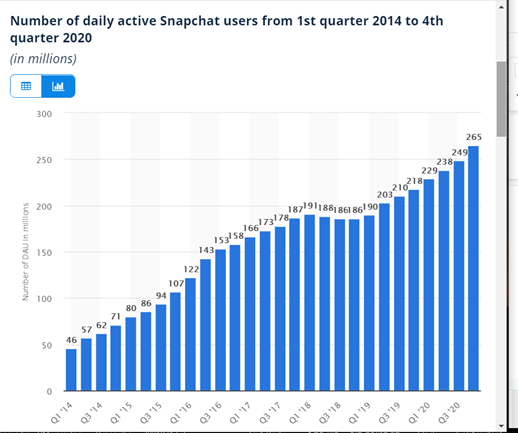

Snapchat breaks the mold of other social platforms by offering to post short-lived content. This underrated social platform had Stories before Instagram. The app allows you to share messages that self-delete in up to 10 seconds. Snapchat now is one of the most popular social platforms for teens.

- 265 million daily active Snapchat users worldwide.

- 60% of Internet users between 13-24 in the U.S. use Snapchat.(DataReportal)

- 210 million snaps are created in Snapchat every day (Snapchat)

- Snapchat is the 2nd most used application on mobile. (Sandvine)

- The average Snapchat user opens the app 20 times a day. (Snapchat)

Tiktok

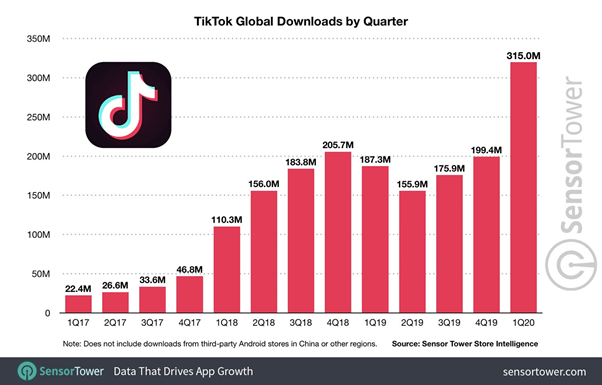

The app has revolutionized the social media world by allowing people to post short videos with music. Within a year of development, the app reached 1 million views per day. The app started growing when acquired Musical.ly in 2017, which allowed it to cater to an existing market. During the pandemic, the app experienced a huge spike in engagement with a growth of 180% among 15-25 year old users.

- TikTok has 732 million active users.

- The app has over 2 million downloads on the Google Play Store and Apple’s iOS Store.

- 62% percent of Tiktok users are aged 10-29.

- Users spend an average of 52 min per day on the app.

- 90% of TikTok users are in the app every day.

- On average, 1 million TikTok videos are viewed every day.

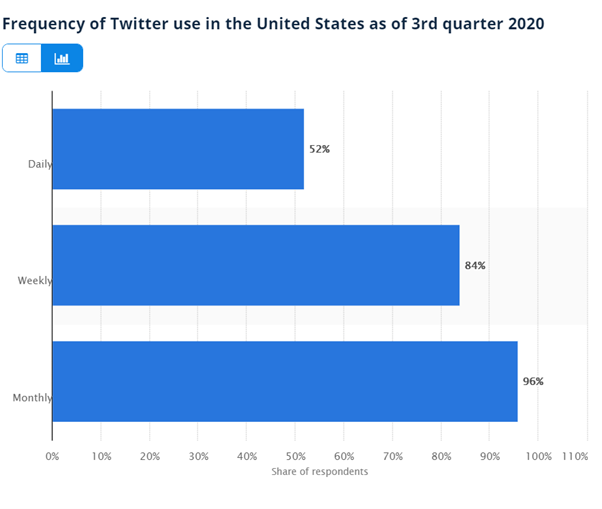

According to Statista, Twitter currently ranks as one of the social networks with more active users.

- As of the end of 2020, Twitter had 192 million monetizable daily active users.

- Twitter’s global revenue is $3.72bn.

- The advertising revenue is $3.21bn

- The number of global users is projected to reach 340 million users by 2024.

YouTube

YouTube is now the second most used social platform after Facebook. Most Facebook users also have a YouTube account. It is also one of the most monetized channels.

- YouTube has 3 billion active users worldwide.

- 79% of online users have a YouTube account.

- Users watch an average of a billion hours of video every day. (YouTube)

- More than 70% of YouTube watch time comes from mobile.

- 90% of users discover brands or products on YouTube.

- It is the most popular channel for digital video consumption.

- YouTube ad revenues in 2020, were or $77bn

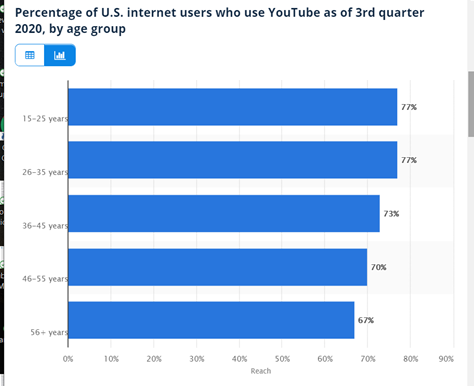

- Most YouTube users are under 35 years old

- The best-paid YouTuber in 2020 was Ryan Kaji, a 9-year-old.

Source: Statista

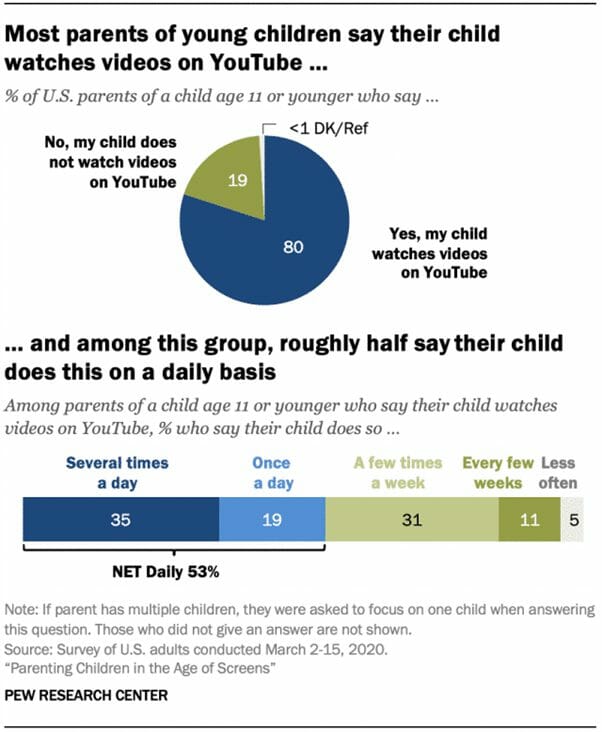

- Most parents say their children 11 years and younger watch YouTube videos on a daily basis.

Social media management

- Facebook, Instagram and Twitter are the most common social media platforms used by marketers (HubSpot)

- The most used marketing tactic is social listening (HubSpot)

- Marketers say social media increases brand exposure. (Statista)

- Most companies publish 3-4 times a week on social media. (HubSpot)

- Customer acquisition is the top goal for social media, according to 73% or surveyed marketers. (Hootsuite), followed by driving conversions with 66%.

4. Mobile App Advertising Stats and Trends

In recent years, as people fulfill more activities on their phones, the mobile apps market has increased significantly. Here are some stats:

- 218 bn app downloads worldwide in 2020.

- $120bn was the consumer spending in mobile apps in 2019.

- 32% is the user retention rate of mobile apps.

-

- The user’s screen time on mobile increased to 4.2 hours.

- Mobile advertising costs were $240bn.

- According to a study by SensorTower, the top non-game app in revenue is TikTok, followed by YouTube and Tinder.

- In Google Play, the most-downloaded app is Google One, followed by Disney+

- In the App Store, the most downloaded app is TikTok, followed by YouTube.

Gaming app revenue 2021

Games usually drive the mobile app segment, but since the pandemic, games download has increased to 45% in 2020, compared to the previous year.

Which were the top mobile games in revenue? According to Sensor Tower, the top five mobile games earned over $1billion in 2020.

- PUBG Mobile is the mobile game with the most revenue on the App Store and Google Play in 2020, with $2.6 bn in revenue.

- The total revenue for gaming apps reached $35 bn in the first quarter of 2021.

-

Email marketing statistics

Email marketing is one of the most popular marketing tactics. According to HubSpot, monthly email campaigns have a 30% open rate.

- The number of active email users is expected to reach 4.3 billion in 2023. (Statista)

- The average ROI of email marketing is $42 for every $1 spent.(DMA)

- 90% of marketers use email marketing to deliver content.(Content Marketing Institute)

- 81% of small businesses use email for customer acquisition. (Emarsys)

- Despite a lower general open rate, 82% of welcome emails are opened. (GetResponse)

- Adding videos to your emails, increase click rates by 300%.

- 49% of consumers like to receive promotional emails from their favorite brands.

-

Digital ad statistics 2021

- Digital advertising spending is expected to reach $389bn in 2021. According to eMarketer, spending will increase at a rate of 17% in 2021.

-

- The average cost per action (CPA) for advertising is $49 for paid search ads and $75 for display ads. (WordStream)

- Social media ad spending increased 20% in 2020, reaching $43 billion. (eMarketer)

- Mobile display ad spending reached $61bn in 2020. This represented an increase of 22% from 2019, according to eMarketer.

- Omnichannel campaigns perform better than a single channel.

- Customer retention rates are 90% higher for omnichannel campaigns. Loyalty rates are also higher in companies that offer engagement in several channels. (ClickZ)

-

Online Shopping Statistics

Online shopping turned into the new normal and companies needed to adapt to it for survival. Online shopping has many advantages:

- It’s convenient

- You can opt for next-day delivery

- Your shopping experience is more personal.

How many people shop online? According to Statista, in the U.S. e-commerce is expected to go over $740bn by 2023.

- Amazon is the most popular mobile online shopping app. According to a Statista study in 2019, Amazon is the most popular shopping app.

- 43% of online shoppers research products online using social networks.

- 22% of global retail will come from eCommerce by 2023.

- Over 75% of customers shop online at least once a month.

-

FOMO Statistics

Everybody heard about FOMO (Fear of Missing Out). Tapping in this emotion is one of the most effective marketing strategies nowadays. It involves people wanting to stay connected with what others are doing or having, fearing that they’ll miss out on rewarding experiences.

- 69% of millennials experience FOMO (Eventbrite)

- 60% of millennials make reactive purchases because of FOMO (Strategy)

- The biggest triggers of FOMO are travel, events and food (Strategy)

Where can you find reliable marketing statistics?

Finding accurate, up to date and reliable marketing statistics is not easy. Still, if you want to define an effective digital marketing strategy, you need to start with data. Using reputable sources like the sites we explain below, you’ll create a competitive advantage.

In Statista you can find a market, consumer data, consumer survey results and industry studies from 22500 sources. Is the go-to place for reliable industry statistics.

This company approaches research from the side of marketers as well of consumers. They provide reliable industry data and useful facts.

Focused on the media industry, Nielsen measures across channels and platforms to discover audience interests and behavior. You can find here social media listening and audience statistics.

It is one of the leading information technology research and advisory companies. They focus on technical analysis and statistics.

This leading global market research company provides studies, statistics, research and papers about customer research.

Focuses on social media marketing statistics. Publishes an industry report, and several studies, statistics.

Find here business statistics, reports, and studies on finance, innovation, and media.

You can discover what the world is searching by using Google Trends. You just enter a search term or topic and select a region or worldwide search. You can also let Google tell

you what people are looking for.

What’s Next?

Keeping up to date with the latest statistics is critical for a successful digital marketing strategy. Especially if you want to monetize your digital property, be it a website or an app, having the latest and accurate data is essential.

CodeFuel is a complete monetization platform that lets you leverage search, ads, shopping, and news to monetize your website or application. Our solution uses intent search to present relevant ads, allowing you to monetize while improving the user experience. You can give personalization and increase conversions, build loyalty, and improve brand recognition.

Learn more about how CodeFuel helps you monetize and grow your business.