Video marketing is here to stay. Companies that want to engage, entertain and capture the attention of users should think of adding video content and ads to their marketing statistics. If an image is worth 1000 words, a video is worth much more. To be sure you get the most accurate information before you start your video campaign, here at CodeFuel we’ve collected a list with the most important video marketing statistics you should know for 2024, and some tips to create a great video campaign.

In this post

Is Video Marketing More Effective?

Video marketing gives marketers an attractive and shareable medium to reach their audience. A study recently showed that online video is 6 times more effective than other marketing tools.

Here are some statistics about how effective is adding videos to your marketing strategy:

What is the ROI of video marketing?

Video marketing requires production, planning, and investment. Because of that, it is important for marketers to know their video strategy is going to be successful.

Video can produce a better ROI, than traditional marketing methods. Let’s check what marketers think about it.

- 86% of marketers say video increased traffic to their website.

- 83% of marketers say video increased their visitor’s time-on-page.

- 84% of marketers admit videos helped generate leads.

- 78% of marketers say adding video to their pages increased sales.

In order for the video strategy to be effective, you should be able to measure success. How are your videos performing against your goals? To help with that there are certain metrics that can help.

Metrics You Should Know

Every marketing campaign will have different metrics according to the campaign goals. But, when measuring the performance of your video campaign there are some common metrics to take into account.

Video Engagement Metrics

Engagement is the measure of how your video content impacts the user. How much do your viewers interact with your brand?

- Likes: the “likes” in social media and positive reactions to your video content.

- Dislikes: this is an option on YouTube, Facebook, and other platforms. People can express their disagreement with the subject or the content.

- Comments: comments give you an idea of how impactful is the content for the users. You can check sentiments toward the videos, feedback on the content. They also create a conversation with the viewers.

Conversion Metrics

If your goal for your video campaign is conversions, you should always include a CTA in the video. While it could be at the end of the video, some companies will repeat variations of the CTA through the duration of the piece, in case the viewers don’t watch it completely.

- Click-through-rate: CTR is relevant for video campaigns focused on conversions. You’ll like to know how many people clicked on your video CTA or follow through with the desired action.

- Conversions: You should track not only the number of people that click on your video CTA but the ones that actually purchase or convert on your website. This will give you a more accurate idea of whether your campaign was successful until the end.

Awareness and Reach

Well, conversions and engagement won’t happen without people being aware of your brand. Here are the metrics that you should track to know where you stand on brand awareness:

- Views: How many times your video gets watched. What is considered a view? It depends on the platform. On YouTube is 30 seconds, on Facebook and Instagram is 3 seconds.

- Play rate and replays: Play rate measures how many times a user clicks the play button on your videos. Replays measure how many times the user played your video again.

- Shares: Shares can be the ultimate uplift. That means a viewer liked your video so much that they want to share it. This impacts your campaign since the more people see your videos, the larger audience you can reach.

- Impressions: Impressions mustn’t be confused with views. An impression is when your video is displayed, whether someone clicks on it or not. You can have a ton of impressions but very few views.

47 Video Marketing Stats

You cannot ignore video content as part of your marketing strategy. Here are some statistics that show this:

Online Video Usage and Consumption

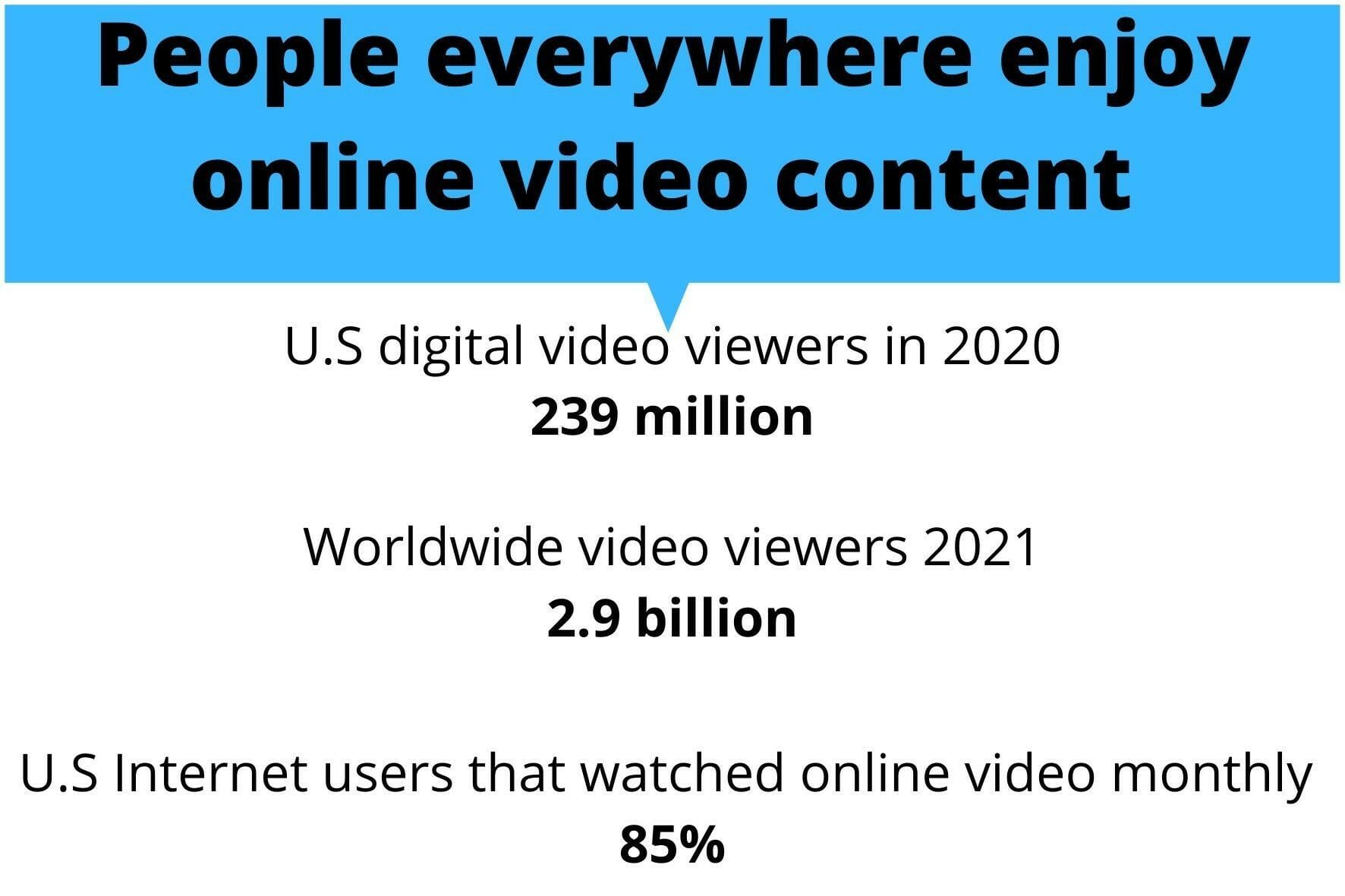

1. Online video usage is increasing

2. People are watching online videos more than ever, on any device. According to a report by Statista, the number of people watching online videos worldwide will reach close to 3 billion in 2021.

3. In the U.S the number of users watching online videos is over 80%. At least 85% of American Internet users watched an online video last month.

4. Almost 300 million U.S residents watch videos regularly.

The global weekly time watching online videos also increased.

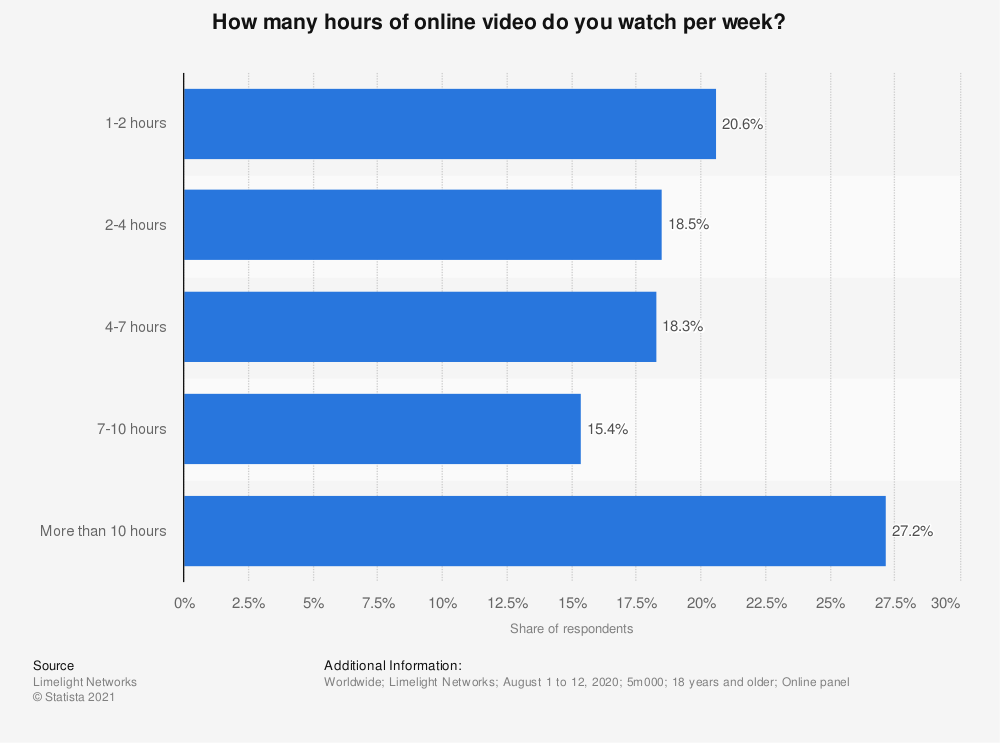

5. According to a video viewer survey, in August 2020, almost 30% of online viewers watches more than 10 hours of online video weekly, and 20% watched one or two hours of online video weekly.

6. In the U.S, 78% of people watch online videos each week, and 55% of those watch on a daily basis.

Consumers demand more online video content

7. According to a study by HubSpot, 54% of consumers want to see more online video content. Consumers not only want to watch entertainment videos. According to that study, customers would like to see more video content from brands they support or follow.

This demand is one of the reasons influencer video creators are on the rise. Video content catches the users’ attention. Therefore, brands looking to expand their brand exposure should add video content to their strategy.

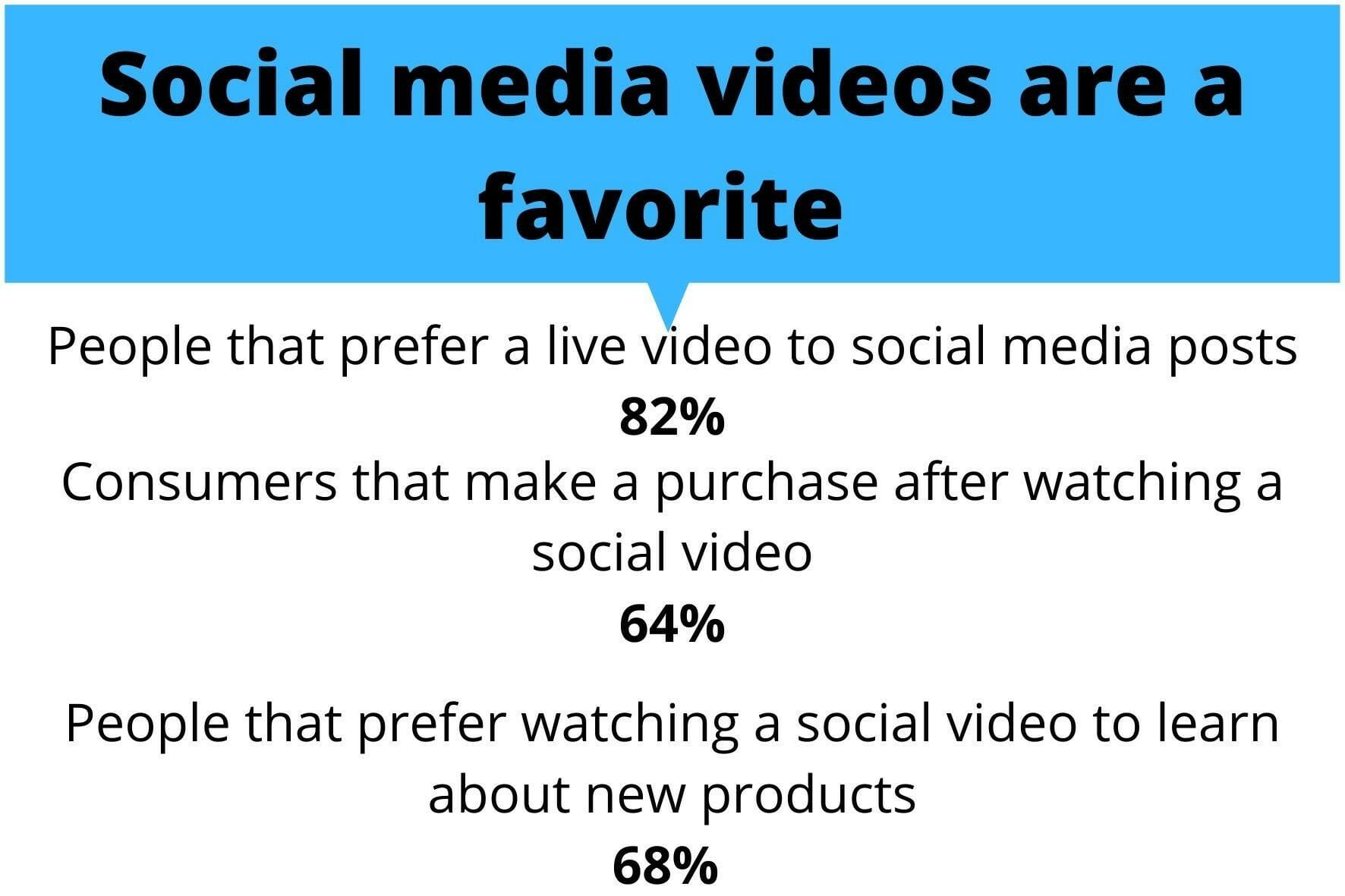

8. Consumers especially like videos on social media platforms

Top Video Platforms

YouTube Video Statistics

YouTube has grown in an unstoppable way since its launch in 2005. The platform is the go-to place for longer video content, specifically tutorials (on almost everything) and educational videos.

Here are some statistics that show why should you consider YouTube marketing:

YouTube usage

9. 48% of business YouTube users think the platform enhances PR communications.

10. 82% of viewers use YouTube for entertainment.

11. 18% of people follow brands and companies on YouTube.

12. 37% of 30-49 years old use YouTube as a news source.

13. 72% of YouTube viewers used YouTube to exercise in 2020.

14. The average YouTube visitor checks 8.8 pages per day.

15. 40% of viewers watch YouTube on their mobiles.

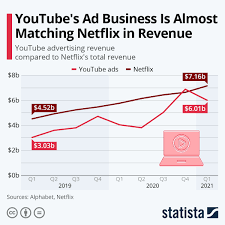

YouTube marketing

16. YouTube’s ad revenue as of 2021, reached over $6 billion.

17. YouTube’s ad business is close to Netflix in revenue. YouTube’s parent company revealed the data for the first quarter of 2021, and it is expected to reach over $20 billion in ad revenue this year.

18. 70% of YouTube viewers, purchased from a brand that they saw on YouTube.

19. YouTube intent-targeted ads perform 100% better than those targeted by demographics.

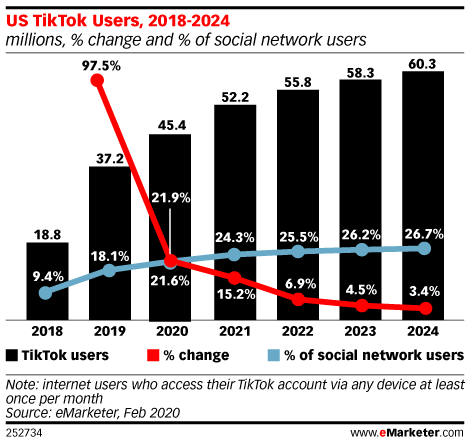

TikTok Video Statistics

The TikTok (or Douyin as it is called in China) app is one of the most popular applications for creating video content in 2021. Users can create short musical videos based on lip-syncing, dancing, workouts, or comedy. Thus, in 2021, TikTok is an app that is tough to beat.

20. There are about 689 million active TikTok users every month, according to the platform.

21. The platform has 600 million active users in China.

22. TikTok 2020 revenue was estimated at $1 billion.

23. 18% of global Internet users use TikTok.

24. In the U.S, there are 100 million TikTok users.

25. In Europe, the U.K is the country with the most TikTok users, and Norway is the one with the fewer.

26. U.S users spend an average of 14 hours a month in TikTok.

27. 48% of TikTok users will share a funny video.

Video Conversion Statistics

The ultimate goal for a video marketing campaign is to convert. Videos can generate effective results for campaigns. Here are some statistics that show how video influences positively your conversions:

28. The average conversion rate for websites with video is 4.8% instead of 2.9% for sites without.

29. Branded video content increased over 200% on Facebook and 100% on YouTube.

30. Facebook, partnering with Nielson, found out that video ads increase conversions by 20-30%.

How Effective Is a Video for Brand Awareness

Videos can create and increase the awareness of your brand. Video marketing can give your viewers information that a regular ad cannot. It shows your audience that your brand is aligned with their values.

31. 86% of businesses use video as part of their marketing strategy.

32. 76% of marketing professionals use video to increase their brand awareness.

33. 80% of people say they use online search and video search when researching something to buy.

Does Video Affect the Sales Funnel?

To be truly effective, your videos need to align with your sales funnel. Regardless of your campaign goals, creating them to cater to the right stage of the sales funnel will increase your chances of converting. For instance, if your goal is to raise brand awareness, your video content should show your brand values.

If your campaign goal is to convert, the ad should align with the buyer’s needs at the consideration stage, ending with a CTA. Check this example by Uber:

Posting Video on Social Media

Social media is key when we talk about video marketing. Videos perform better in social media channels and people actually like more video ads and content on those platforms. Here’s a quick view of how videos perform on each of the big social platforms:

Facebook Video Statistics

34. Facebook video posts have a 0.26% engagement rate. That’s higher than the overall engagement rate for text posts (0.18%).

35. 1.25 billion people visit Facebook Watch every month. To be able to publish on Facebook Watch, you need to have more than 5,000 followers.

36. 70% of marketers will include Facebook in their video marketing strategy.

Instagram Video Statistics

37. The most popular Instagram video content is how-to tutorials. Following are interviews and behind-the-scenes posts. So, plan to add short instructional videos that can relate to your business.

38. Instagram TV videos are larger than the pictures on the Explore page. Use IGTV videos to draw your audience’s attention.

39. Reels get more engagement than video posts. Take, for example, the NFL team The Patriots. They get an average of over 121,000 engagements per reel, vs 21,000 engagements per video.

Twitter Video Statistics

40. Video arrived on Twitter for staying. Video views on Twitter reached 62% in 2020.

41. Video is the most shared media type. Tweets with videos get retweeted 6 times more than photo Tweets.

42. Twitter videos usually get created or shared on mobile. 93% of Twitter video views happen on mobile.

43. Twitter videos start conversations. Twitter has a new ad format called Conversational Ads. The video ads may include CTA buttons and customizable hashtags.

Linkedin Video Statistics

44. LinkedIn launched video ads to help grow their customer’s businesses.

45. Users at LinkedIn are 20 times more likely to re-share a video post compared to a text post.

46. LinkedIn ads can increase purchase intent by 33%.

47. LinkedIn Live streams generate 7 times more reactions than a regular video.

3 Tips for a Perfect Social Media Video Strategy

1. Videos perform better when they are short.

If you want to succeed with your social media videos, short and sweet is the way to go. That is even more important for B2B. Videos shorter than one minute, get viewed completely 68% of the time, unlike videos 10 minutes and longer, which has a 25% completion rate.

Why is this important? Consumers want fast-paced content. So, you can create short videos using trending platforms like Instagram Reels and TikTok to promote them. A short video gives you also the possibility to re-share them as Stories, adding special effects, filters, stickers, etc, to attract more the attention of your viewers.

2. Use YouTube for educational videos

YouTube is the default channel for video tutorials and How-To educational videos. Since tutorials are a must on your video content strategy, take advantage to show and instruct your users about how your solution work. Explainer videos work wonderfully for that.

3. Dare to live stream

Audiences engage 3 times more with live videos than other types of videos. It can be because the experience feels more genuine and direct with the content creators. Live streams show the human side of your brand, helping customers relate more with your values and goals. So, if you want to reach directly to your users, run a live session on social media.

4 Top Video Marketing trends of 2024

1. Video marketing will be a standard part of marketing strategies

According to research, 99% of marketers plan to use video in their strategies in 2021. The most popular forms of video content are explainer videos, testimonials, and video ads.

2. Everybody goes live these days

The average U.S consumer has more than 9 video streaming apps on their smartphones. Global streaming marketing is growing steadily over the last few years, reaching over $160 billion in revenue in 2020, from $104 billion in 2019. According to analysts, the sector will continue to grow in 2024.

3. Shorter is better

If you want to catch your user’s attention, keep your videos short and entertaining. That’s behind the success of short-form streaming solutions like Reels and TikTok. According to Design Shack, this trend will continue, including monetization opportunities — already present in Instagram and in development in Tiktok—.

4. The top star: User-Generated video content

According to Econsultancy, users that find user-generated video content in an e-commerce platform are almost 2 times more likely to purchase. The reason is simple. Users want to know the personal experiences of people that already bought the product. This is very popular in fashion and homeware sites for exactly this reason. It provides a “live review” that is authentic and relates to the buyer.

Wrap Up

Wow, that’s a handful!. When thinking about ramping up your video marketing strategy, getting the proper stats is key for a successful campaign.

Here are some of our recommendations for a great video campaign: Start with a plan, choose carefully the channels you will use for your video campaign. Even better, choose a complete ad network solution that can maximize the impact of your video ads. When launching the campaign, track the metrics, measure performance, rinse and repeat.

Crafting the perfect video campaign is not easy. Hopefully, with this post, we provided the key stats to get you started.

Resources: